Boost Your Service Earnings with the most up to date 2D Payment Gateway Solutions

Boost Your Service Earnings with the most up to date 2D Payment Gateway Solutions

Blog Article

The Role of a Repayment Entrance in Streamlining Shopping Repayments and Enhancing Individual Experience

The assimilation of a repayment portal is essential in the e-commerce landscape, offering as a protected avenue between customers and vendors. By enabling real-time purchase processing and sustaining a variety of settlement methods, these portals not only minimize cart abandonment yet also enhance overall consumer complete satisfaction.

Recognizing Payment Entrances

A payment entrance acts as an important intermediary in the shopping transaction process, facilitating the secure transfer of repayment details between clients and sellers. 2D Payment Gateway. It makes it possible for on-line companies to approve numerous forms of repayment, consisting of credit score cards, debit cards, and electronic wallets, thus expanding their client base. The entrance operates by securing sensitive information, such as card details, to make sure that information is sent securely online, minimizing the danger of fraudulence and information violations

When a consumer initiates a purchase, the payment gateway captures and forwards the transaction data to the suitable monetary organizations for permission. This procedure is commonly smooth and takes place within secs, giving consumers with a liquid purchasing experience. In addition, settlement portals play an essential function in conformity with market requirements, such as PCI DSS (Payment Card Industry Information Security Criterion), which mandates rigorous safety procedures for refining card repayments.

Understanding the mechanics of settlement entrances is important for both merchants and customers, as it straight impacts purchase performance and customer trust. By making sure effective and protected purchases, repayment gateways add considerably to the total success of ecommerce businesses in today's electronic landscape.

Key Attributes of Payment Portals

Several vital functions specify the efficiency of payment entrances in shopping, guaranteeing both security and comfort for users. Among one of the most important features is durable security methods, consisting of encryption and tokenization, which shield sensitive consumer information during purchases. This is important in cultivating count on in between customers and merchants.

Moreover, real-time purchase processing is vital for making certain that repayments are completed promptly, minimizing cart abandonment prices. Repayment gateways additionally provide fraud discovery tools, which check deals for dubious activity, more securing both consumers and sellers.

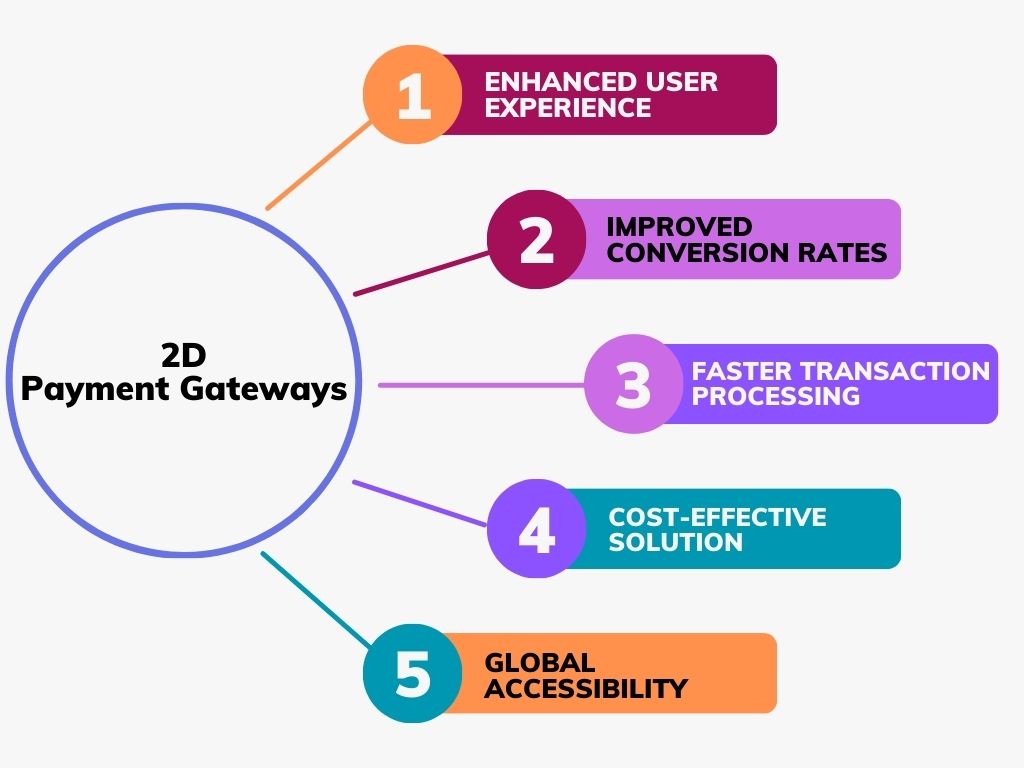

Benefits for Shopping Companies

Countless benefits emerge from integrating settlement entrances into e-commerce services, significantly improving functional effectiveness and consumer complete satisfaction. First and leading, repayment portals help with smooth purchases by securely refining settlements in real-time. This capacity reduces the possibility of cart desertion, as consumers can swiftly complete their acquisitions without unnecessary delays.

Furthermore, settlement portals sustain numerous settlement methods, suiting a varied variety of client choices. This adaptability not just attracts a wider client base yet additionally cultivates loyalty among existing clients, as they feel valued when provided their favored settlement alternatives.

Furthermore, the integration of a payment portal commonly results in enhanced protection functions, such as encryption view website and fraudulence detection. These measures shield sensitive consumer info, thus building trust and reputation for the ecommerce brand name.

Moreover, automating payment procedures through entrances minimizes hands-on workload for personnel, allowing them to concentrate on strategic efforts as opposed to routine jobs. This operational effectiveness converts into price savings and enhanced source allotment.

Enhancing Customer Experience

Integrating an efficient settlement entrance is critical for enhancing individual experience in shopping. A seamless and effective repayment procedure not only develops customer trust however additionally minimizes cart abandonment prices. By giving multiple repayment alternatives, such as charge card, digital purses, and bank transfers, services deal with varied customer preferences, consequently boosting satisfaction.

Moreover, an easy to use user interface is necessary. Settlement gateways that offer user-friendly navigation and clear directions allow customers to full deals swiftly and easily. This convenience of usage is essential, specifically for mobile shoppers, that call for maximized experiences customized to smaller sized displays.

Protection attributes play a substantial duty in customer experience also. Advanced encryption and fraud discovery devices guarantee clients that their sensitive data is protected, cultivating self-confidence in the deal process. Additionally, clear interaction concerning fees and plans enhances credibility and reduces possible irritations.

Future Patterns in Payment Handling

As ecommerce continues to advance, so do the innovations and trends shaping settlement processing (2D Payment Gateway). The future of payment handling is marked by numerous transformative trends that assure to improve efficiency and customer complete satisfaction. One significant pattern is the rise of fabricated intelligence (AI) and equipment knowing, which are being increasingly incorporated right into repayment portals to boost security with innovative fraud discovery and risk evaluation

In addition, the adoption of cryptocurrencies is gaining traction, with more organizations checking out blockchain modern technology as a practical choice to traditional repayment approaches. This shift not only uses reduced transaction charges yet also charms to an expanding demographic that values decentralization and personal privacy.

Contactless payments and mobile purses are becoming mainstream, driven by the demand for much faster, more convenient deal techniques. This fad is further sustained by the raising prevalence of NFC-enabled tools, making it possible for seamless deals with simply a faucet.

Last but not least, view the focus on regulatory compliance and data security will shape repayment handling approaches, as businesses strive to build count on with consumers while adhering to developing legal frameworks. These patterns collectively suggest a future where repayment processing is not only quicker and much more safe however likewise a lot more straightened with consumer expectations.

Verdict

To conclude, settlement gateways function as essential components in the ecommerce ecological community, assisting in secure and effective deal handling. By offering diverse company website repayment alternatives and focusing on user experience, these entrances substantially reduce cart abandonment and improve client satisfaction. The ongoing development of settlement modern technologies and security steps will additionally reinforce their duty, making certain that e-commerce companies can satisfy the demands of progressively innovative consumers while fostering trust and trustworthiness in on the internet purchases.

By making it possible for real-time purchase handling and sustaining a range of payment approaches, these portals not just alleviate cart desertion however likewise improve overall customer satisfaction.A payment gateway offers as a crucial intermediary in the e-commerce transaction procedure, promoting the safe and secure transfer of settlement details in between consumers and sellers. Repayment gateways play a critical role in conformity with sector criteria, such as PCI DSS (Repayment Card Industry Information Safety And Security Standard), which mandates stringent security steps for processing card payments.

A functional repayment gateway suits credit report and debit cards, digital wallets, and different payment approaches, providing to diverse client preferences - 2D Payment Gateway. Settlement entrances facilitate smooth transactions by safely processing settlements in real-time

Report this page